Counties study child-care needs

Jackson, Jennings and Bartholomew foundations combine efforts in Lilly Endowment GIFT VIII planning grant process

March 11, 2024

The Community Foundation of Jackson County

Representatives of the community foundations in Jackson, Jennings and Bartholomew counties recently gathered with other local partners at the Community Foundation of Jackson County to discuss child-care needs in the region.

The foundations are teaming to develop a Lilly Endowment Inc. GIFT VIII grant application to help move the needle forward in the area of child care on a regional basis.

The convening followed three town hall-style meetings in Columbus, North Vernon and Seymour that brought child-care providers, parents and others together to discuss how to lift up child-care delivery in our three counties. A regional Lilly Endowment Inc. GIFT VIII Planning Grant is funding this work. A goal is developing a plan to help providers and families overcome their barriers.

“We are pleased to join Heritage Fund of Bartholomew County and the Jennings County Community Foundation to collectively examine what is working, what is challenging us and how we might collectively help move child care in our communities forward,” Community Foundation of Jackson County President and CEO Dan Davis said. “We are convinced that child care is as much of a workforce issue as it is a family issue for many in the community.”

Heritage Fund President and CEO Tracy Souza said the objective for this work was summed up well in the grant application to Lilly Endowment.

“Reliable, developmentally appropriate, dependable and affordable child care lays a strong foundation for the future development of children, enables caregivers to work and provide for their families and empowers employers to thrive,” Souza said.

Jennings County Community Foundation Executive Director Kelly Kent is excited about the work taking place.

“What a great opportunity we have been given by Lilly to hear from families, employers and child care providers about the hurdles they face in our communities for child care,” she said. “By collaborating with Bartholomew and Jackson counties, we can begin working together to incorporate new ideas and overcome the challenges facing the families and businesses in our community.”

Input from the three community meetings are being curated to help shape a regional grant proposal.

ABOVE: From left, Tracy Souza of The Heritage Fund The Community Foundation of Bartholomew County and Amber Fischvogt and Kelly Kent of the Jennings County Community Foundation discuss comments collected at recent town hall-style convenings focused on the barriers confronting child-care providers, parents and other community partners.

ABOVE: Community partners from Jackson, Jennings and Bartholomew counties review findings from three recent community meetings in Columbus, North Vernon and Seymour as a part of Lilly Endowment Inc. GIFT VIII Planning Grant work in the region.

Lilly grant funds mental health summit

Foundation partners with Healthy Jackson County, Schneck

February 19, 2024

The Community Foundation of Jackson County

The Community Foundation of Jackson County joined with Schneck Medical Center and Healthy Jackson County to stage the second Jackson County Mental Health Summit on Feb. 8 at Camp Pyoca.

The Foundation funded the second health summit through a Lilly Endowment Inc. GIFT VIII Planning Grant, President & CEO Dan Davis said.

“The Foundation is eager to learn how it might be able to support efforts to confront the mental health and substance use disorder challenges that face our community,” Davis said. “Helping bring the summit together to review the current state of things, where we need to be and what needs to be done to get us there is important for everyone in the community.”

Lindsay Sarver with Healthy Jackson County said the summit was about celebrating the different things that are here now that weren’t here a year ago when the first Mental Health Summit was staged.

The meeting included reports and breakout sessions to receive feedback about local solutions to challenges revolving around mental health and substance use disorder.

Sarver said anyone who thinks they have not been touched by mental health issues is either not paying attention or not telling the truth.

“I think half of all adults are going to have a mental illness at one point in their lifetime, even if it is not chronic, because depression and anxiety is for everybody,” said Sarver. “I joke sometimes that I don’t struggle with anxiety. It comes very naturally. There’s plenty to be anxious about in this world.”

After Schneck President and CEO Dr. Eric Fish gave some welcoming remarks, Meghan Warren with the Healthy Jackson County coalition spoke about its work.

“Our goal is really to be able to create and sustain more of a healthy environment and create positive outcomes,” she said. That goal is achieved by the organization’s workgroup. Besides the mental health and substance use group, other groups focus on nutritional and physical activity, feeding the community and Hispanic health.

Kristy Day, director of the emergency department at Schneck, talked about the success of a warm-handoff program for patients experiencing a drug overdose. Day said community health workers and peer recovery coaches Gleeda Lasher and Sara Bowling deserve credit for a lot of the program’s success.

“Without Sara and Gleeda, this wouldn’t be possible,” Day said. “They went above and beyond for all our patients. We have seen an over 50% reduction in overdoses.”

Indiana Health Centers CEO Ann Lundy spoke about work the organization’s center in Seymour has been able to carry out through medication-assisted treatment and medications for opioid use disorder provided to its clients over the past year. Schneck has provided technical assistance and grant support for those treatments.

“What a difference a year can make,” Lundy said. “I know last year at this time, most of us were here. At this time last year, Indiana Health Centers, we were not doing any treatment for substance use. We stood here and committed to all of you that was going to change, and I’m really pleased to tell you that it has.”

Indiana Health Centers, which was established 40 years ago, operates 10 offices around the state, including one in Seymour.

Lundy said over the past year, the Seymour center has seen 72 patients complete follow-up visits for substance use and medication.

“This is our community. These are our patients. These are our family members, and there’s no discrimination here,” she said “It touches across all ages and demographics, and to really be able to increase access and be able to address and offer these services is such an incredible honor for us.”

Medora Community Schools Principal Kara Hunt talked about the school’s efforts to identify and address mental health services for students, staff and community since the COVID-19 pandemic started.

Hunt said anyone who has worked with children and families in the past few years knows mental health is becoming an issue for them.

ABOVE: Dr. Eric Fish shares information about mental health services and the work of Healthy Jackson County during the recent Jackson County Mental Health Summit. Fish, a member of the Community Foundation of Jackson’s Board of Directors, is the president and chief executive officer of Schneck Medical Center.

ABOVE: Indiana Health Centers CEO Ann Lundy, center, leads a breakout session during the second Jackson County Mental Health Summit on February 8 at Camp Pyoca near Brownstown.

ABOVE: Foundation President & CEO Dan Davis presents a copy of “Where to Start” to Stacey Parisi of Seymour Community Schools at the second Jackson County Mental Health Summit. The books, which were presented to the county’s schools, were funded with a Fall Grant from the Foundation to Healthy Jackson County and Schneck Medical Center. He made the presentations on behalf of Healthy Jackson County during the second Jackson County Mental Health Summit on February 8 at Camp Pyoca near Brownstown.

Foundations partner on child-care study

Lilly Endowment Inc. GIFT VIII Planning Grant funds work

February 19, 2024

The Community Foundation of Jackson County

The community foundations of Bartholomew, Jackson and Jennings counties are bringing community partners together through a grant from Lilly Endowment Inc. to study regional child-care challenges and how those barriers can be confronted with a collaborative regional approach.

First Children’s Financial, a national leader in child-care business development and financing, has been contracted to work with The Community Foundation of Jackson County, Jennings County Community Foundation, Heritage Fund–The Community Foundation of Bartholomew County, the Community Education Coalition’s Early Learning Initiative, Ivy Tech Columbus, Child Care Network Inc. and Jennings County School Corporation to engage each county in conversations around the strengths and challenges their community has to support sustainable child-care options.

Heritage Fund President and CEO Tracy Souza noted, “Our objective for this work was summed up well in our grant application to Lilly Endowment. Reliable, developmentally appropriate, dependable, and affordable child care lays a strong foundation for the future development of children, enables caregivers to work and provide for their families, and empowers employers to thrive.”

The three counties also make up the READI region known as the South Central Indiana Talent Region, noted President & CEO Dan Davis of the Community Foundation of Jackson County.

“We are pleased to join Heritage Fund and Jennings County Community Foundation to collectively examine what is working, what is challenging us and how we might collectively help move child care in our communities forward,” Davis added. “We are convinced that child care is as much of a workforce issue as it is a family issue for many in the community.”

Jennings County Community Foundation Executive Director Kelly Kent agreed.

“What a great opportunity we have been given by Lilly to hear from families, employers and child-care providers about the hurdles they face in our communities for child care. By collaborating with Bartholomew and Jackson counties we can begin working together to incorporate new ideas and overcome the challenges facing the families and businesses in our community,” she said.

An important component of this work will be gathering information and input from stakeholders across the three-county region including child-care providers, parents, employers and other partners. Town Hall meetings will be conducted in each county.

On-site child care, dinner and a stipend for participants will be provided in an effort to include as many voices as possible.

ABOVE: A pre-school student in the Child Care Network’s Emerson Elementary School reads a book recently. The agency is working with other child-care providers in Jackson, Jennings and Bartholomew counties to study the needs of child care in our communities,

If you go

The meetings are scheduled from 5:30-8:30 p.m. at the following locations on the following dates:

- Jackson County: February 27, Child Care Network Inc, 414 N. Chestnut St., Seymour.

- Bartholomew County: February 28, Columbus Learning Center, Summerville Room, 4555 Central Ave., Columbus.

- Jennings County: February 29, Jennings County High School, 800 W. Walnut St., North Vernon.

To register for a Town Hall Meeting or for questions regarding this child-care initiative, contact Kari Stattelman, Director of Consulting, First Children’s Financial, at karis@firstchildrensfinance.org.

Scholarships target adult learners

Applications available now online

February 6, 2024

The Community Foundation of Jackson County

Two scholarships offered through funds at the Community Foundation of Jackson County target non-traditional college students, including adults whose college educations were disrupted at some time in the past.

The Foundation often has trouble finding applicants for the scholarships, said Foundation Vice President Sue Smith, who oversees much of the organization’s scholarship work.

“We don’t know if adult learners planning to attend college or vocational and technical training think there are no scholarships to assist them, but there are some funds available to help them finance their educational costs,” she added. “We need students to apply.”

Those scholarships are the Marvin and Mary Klaes Memorial Adult Scholarship and the Charles and Aileen Roeger Scholarship.

The purpose of the Roeger scholarship is to provide support to Jackson County adult students for tuition, fees and for the cost of learning materials necessary to resume their interrupted education or vocational training. This scholarship will be automatically renewable for up to one additional year, providing a two-year scholarship opportunity.

The Klaes scholarship also provides educational scholarships for Jackson County residents who have been in the workforce for at least one year and who are furthering their education by pursuing an associate’s or bachelor’s degree. It also is renewable for a second year.

Information about both adult learner scholarships is available on this website. Completed applications are due at the Foundation office no later than June 28. The direct link to the scholarship forms is https://www.cfjacksoncounty.org/scholarship-forms/ Scroll down to the “Adult Learners” icon and find “Marvin and Mary Klaes Adult Scholarship” and “Charles and Aileen Roeger Scholarship.”

For information, call the Foundation at 812-523-4483 and ask for Sue Smith or send an email to vicepresident@cfjacksoncounty.org.

Farmers Breakfast spotlights

county’s agricultural economy

21st annual event set February 15 in Brownstown

February 2, 2024

The Community Foundation of Jackson County

Good eats and good information are on the menu when the Community Foundation of Jackson County and Purdue University Cooperative Extension Service serve up the 21st annual Farmers Breakfast.

The event is set for 7:30 a.m. Feb. 15 at Pewter Hall in Brownstown. Doors open at 7 a.m. Admission is free. To attend, call us at 812-523-4483 or by emailing Lori Miller at development@cfjacksoncounty.org.

Michael Langmeier of Purdue University returns as the keynote speaker. Langmeier is a professor and extension economist in the Department of Agricultural Economics and serves as associate director of the Center for Commercial Agriculture.

He will provide an ag forecast at the meeting. We will hope that Jackson County farmers are looking forward to another strong year of production this summer.

Hoosier farmers reported record-high corn and soybean yields in 2023, according to the Indiana field office of the U.S. Department of Agriculture National Agricultural Statistics Services.

State statistician Nathanial Warenski said in a recent report that Indiana corn production totaled 1.08 billion bushels in 2023, or 11% above 2022, and soybean production across the state totaled 334 million bushels, down slightly from 2022.

Yield numbers for Jackson County farmers were not available.

Langmeier joined Purdue University in July 2012. His extension and research interests include cropping systems, benchmarking, strategic management, cost of production and technical and economic efficiency.

Most of his research has focused on the efficiency of farms and ranches, and crop and livestock enterprise production costs and efficiency. He has also conducted research related to tillage systems, biomass crops and the tradeoff between crop rotation profitability and water quality.

Before arriving at Purdue, Langmeier worked 22 years in the Department of Agricultural Economics at Kansas State University.

The farm sector is an important part of the Jackson County community, and the Foundation supports those involved with farming through funds such as the Bob Myers Memorial Scholarship Fund and the C.B. Hess 4-H Memorial Scholarship Fund.

The Foundation also offers farmers an opportunity to donate to those and other funds that benefit the community through the annual Giving the Gift of Grain program and the annual Giving the Gift of Livestock program. We also conduct a light-hearted fundraising competition, the Head to Head: Green vs. Red contest.

Currently, the Green Team is in the lead with 56 percent of the vote. Votes may still be cast through cash donations or gifts of corn or soybeans. The deadline is February 9.

Joining the Foundation and Purdue Extension Jackson County as sponsors of the Farmers Breakfast this year are a number of area businesses and service providers involved with the farming community. They include Premier Ag and Rose Acre Farms, which underwrite the cost of the buffet meal, allowing farmers to enjoy the breakfast at no cost.

Other sponsors include Agnew Auction & Realty, The Andersons, Aquatic Control, B&W Agri-Products, Beacon Ag, Beatty Insurance, Blue & Co., Bob Poynter GMC, Brownstown Veterinary Clinic, Darlage Custom Meats, Dennis & Blish CPA, Donaldson Capital Management, Edward Jones, First Financial Bank, German American Bank, Grindlay & Grindlay, Hackman Show Feeds and Dave Hall Crop Insurance.

Also serving as sponsors are the Ivy Tech Foundation, JCBank, Jackson County Co-Op Credit Union, Jackson County Insurance Agency, Jackson County REMC, Jackson County Tire, Jacobi Sales, Knight Drainage, Lorenzo, Bevers, Braman and Connell, Main Trailer Sales, Montgomery Elsner & Pardieck, Old National Bank, The Peoples Bank, and Royalty Companies.

Other sponsors are Rumpke of Indiana, Schafstall Inc., Schneck Medical Center, Seymour Animal Hospital, State Bank of Medora, Tampico Grain, The Tribune, Wischmeier Trucking and White River Soy Processing.

The Foundation appreciates our sponsors’ support of the local farming community, which provides valuable jobs and income to area residents, as well as the support that they offer to the Foundation and our community.

If you go

What: Farmers Breakfast presented by Community Foundation of Jackson County and Purdue Extension Cooperative Service

When: 7:30 a.m. Wednesday, Feb. 15 (doors open at 7 a.m.)

Where: Pewter Hall, 850 W. Sweet St., Brownstown

To register: Call the Foundation office at 812-523-4483 or send an email to development@cfjacksoncounty.org.

Above: Michael Langmeier, Purdue University.

Below: The Green Team currently leads the Red Team in the Foundation’s friendly competition Head to Head: Green vs. Red.

Foundation participates

in IPA Day at the Statehouse

Senators and House members convene with philanthropy

January 31, 2024

The Community Foundation of Jackson County

Did you know that philanthropy and the nonprofit sector in the Hoosier state works for the common good?

That 1 in 10 Hoosiers work in the nonprofit sector (that’s 301,000 people)?

And that Indiana is home to 1,244 foundations with assets of $25.3 billion and giving of $2.2 billion?

That was among information shared with Indiana’s state senators and members of the House of Representatives during the annual Indiana Philanthropy Alliance Day at the Statehouse on January 31.

Community Foundation of Jackson County President & CEO Dan Davis also shared information with lawmakers about the work supported by and issues confronting philanthropic and grant-making organizations around Indiana, including here at home throughout Jackson County.

Philanthropy invests time and resources to tackle the biggest challenges of our time. Public policy focus areas include education, workforce development, substance abuse/health issues, community/economic development, and quality of place. Dan serves on the IPA’s Public Policy Committee.

“Our goal is to transform communities and lives, by tackling big challenges facing Indiana and own communities and making our state a better place to live,” Davis said. “We do this in part by working with local, state and government officials and of course our community partners here at home.”

Dan spoke with state Rep. Dave Hall of Norman and state Sen. Eric Koch of Bedford, both of whom represent areas of Jackson County in their respective districts.

“We always enjoy IPA Day at the Statehouse,” Dan said. “It’s a great opportunity to extend conversations we already have with our lawmakers here at home, and seeing the beauty of the Indiana Statehouse in person is always a treat.”

——-

Dan Davis is president and CEO of the Community Foundation of Jackson County. The Foundation offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Foundation President & CEO Dan Davis speaks with state Rep. Dave Hall of Norman and JoAnna Ness of the Indiana Philanthropy Alliance during IPA Day at the Statehouse on January 31.

Foundation President & CEO Dan Davis speaks with state Sen. Eric Koch, left, and Brown County Community Foundation CEO Alice Susemichel, top right, at Indiana Philanthropy Alliance Day at the Statehouse.

Brownstown Central High School student receives 2024 Lilly Endowment Community Scholarship

Jenna Bolte emerges from 127 applicants

December 6, 2023

The Community Foundation of Jackson County

The Community Foundation of Jackson County is pleased to announce the recipient of the 2024 Lilly Endowment Community Scholarship for Jackson County – Jenna Bolte, a current senior at Brownstown Central High School.

Lilly Endowment Community Scholars are known for their community involvement, academic achievement, character and leadership.

Bolte was among 127 Jackson County applicants this year for the Lilly Endowment Community Scholarship. They were narrowed to 14 finalists, and Bolte was then selected as the nominee, Foundation Vice President Sue Smith said.

“Jenna was selected from a group of outstanding applicants from all six high schools in Jackson County,” Smith added.

With the selection of Bolte, there are now 43 Lilly Endowment Community Scholars from Jackson County, with the first recipient selected in 1998. During the 2024-2025 academic year, there will be four Jackson County Lilly Scholars on college campuses throughout Indiana.

She is the daughter of Suzanne Bolte of Brownstown.

Bolte is in the process of determining where she will attend college next year. She plans to major in chemistry.

“I am interested in becoming a pediatrician,” she said Monday.

Each Lilly Endowment Community Scholarship provides for full tuition, required fees and a stipend of up to $900 per year for required books and required equipment for four years of undergraduate study on a full-time basis leading to a baccalaureate degree at any eligible Indiana public or private nonprofit college or university.

Lilly Endowment Community Scholars may also participate in the Lilly Scholars Network, which connects scholars with resources and opportunities to be active leaders on their campuses and in their communities. Both the scholarship program and network are supported by grants from Lilly Endowment to Independent Colleges of Indiana.

In nominating Jackson County’s Lilly Endowment Community Scholar, consideration was given to academic achievement, advanced curriculum, school and community activities, a required essay and financial need by the Community Foundation’s Scholarship Committee.

After the field of applicants was narrowed, the nominee was submitted to the statewide administrator of the Lilly Endowment Community Scholarship Program, Independent Colleges of Indiana, for the selection of scholarship recipients.

“We have so many high-caliber applicants that it always seems to be such a daunting task to decide on our finalists, but with our thorough application process, the field just seems to automatically narrow down to the best of the best,” said Trina Tracy, chair of the Foundation’s Scholarship Committee.

Lilly Endowment Inc. created the program for the 1998-1999 school year and has supported it every year since with tuition grants totaling in excess of $439 million. More than 5,000 Indiana students have received the Lilly Endowment Community Scholarship since its inception.

The primary purposes of the Lilly Endowment Community Scholarship Program are:

- To help raise the level of educational attainment in Indiana.

- To increase awareness of the beneficial roles Indiana community foundations can play in their communities.

- And to encourage and support the efforts of current and past Lilly Endowment Community Scholars to engage with each other and with Indiana business, governmental, educational, nonprofit and civic leaders to improve the quality of life in Indiana generally and in local communities throughout the state.

Increasing educational attainment among Jackson County residents is an important part of the Foundation’s mission to help grow better tomorrows, said Dan Davis, President & CEO of the Community Foundation of Jackson County.

“Concern about the education levels here was a key factor when the Foundation brought other partners from across the county together to establish the Jackson County Learning Center, and we remain committed to that goal,” Davis said. “It is certainly part of our guiding efforts in administering scholarship funds entrusted to the Foundation.”

The Foundation’s efforts to improve educational opportunities extends beyond programs focused on college, including support of the Jackson County Education Coalition’s On My Way Pre-K pilot program for 4-year-olds and the encouragement of workforce development in partnership with Jackson County Industrial Development Corp. and others.

——-

Dan Davis is president and CEO of the Community Foundation of Jackson County. The Foundation offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Jenna Bolte

From left, Foundation Vice President Sue Smith meets with 2024 Lilly Community Scholar Jenna Bolte and her mother, Suzanne.

About the Community Foundation of Jackson County

-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Its assets total more than $18 million. The Foundation administers more than 250 funds. Among them are 69 scholarship funds. During 2022-2023 school year, 85 Foundation scholarship recipients were on college and university campuses across Indiana and around the nation.

-

For information or to make a donation, call 812-523-4483, or go online at www.cfjacksoncounty.org.

- Online gifts may be made through our website. Click on the “Donate Now” button or hit this link: https://www.cfjacksoncounty.org/donate-now/.

About Lilly Endowment Inc.

- Lilly Endowment Inc. is a private philanthropic foundation created in 1937 by J.K. Lilly Sr. and his sons Eli and J.K. Jr. through gifts of stock in their pharmaceutical business, Eli Lilly and Company.

- While those gifts remain the financial bedrock of the Endowment, it is a separate entity from the company, with a distinct governing board, staff and location.

- Although the Endowment funds programs throughout the United States, especially in the field of religion, it maintains a special commitment to its hometown, Indianapolis, and home state, Indiana.

Pause during shopping frenzy

to make a lasting gift on #GivingTuesday

Day of giving is here

November 28, 2023

By Dan Davis // President & CEO

The Community Foundation of Jackson County

This year’s observance of #GivingTuesday has arrived.

The Community Foundation of Jackson County can help you give back, pay it forward or however else you might look at giving to make a difference. And #GivingTuesday 2023 — set for Nov. 28 — just might be a good way to start.

The program aims to raise awareness of the needs of charitable programs at home and around the world during a time when so many of us are focused on spending for wishes and wants rather than the needs of others.

The Community Foundation of Jackson County asks that you consider helping turn that trend around through making a gift on #GivingTuesday. The event, after all, can be – and really should be — about much more than one day each Christmas and holiday season.

Right now, the Foundation has a $2-for-$1 match available for gifts directed to new or existing community (unrestricted) funds.

For information, call Foundation President & CEO Dan Davis, 812-523-4483.

——-

Dan Davis is president and CEO of the Community Foundation of Jackson County. The Foundation offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

How to give on #GivingTuesday

- You can make a donation to the Foundation by writing a check to the Community Foundation of Jackson County. In the memo line, note the fund to which you are directing your gift. Right now, gifts to community or unrestricted funds can earn a $2-for-1 match. Right. If you donate $500, it will be matched with an additional $1,000.

- Checks may be mailed to the Foundation at P.O. Box 1231, Seymour, IN 47274, or dropped off at the our office, 107 Community Drive in Seymour.

- Online gifts may be made through our website. Click on the “Donate Now” button or hit this link: https://www.cfjacksoncounty.org/donate-now/.

Celebrating community work, support

National Community Foundations Week

November 13, 2023

By Dan Davis // President & CEO

The Community Foundation of Jackson County

Four years ago, Child Care Network and the Community Foundation of Jackson County joined forces and commitment to create a 100-plus seat child-care center in Jackson County, part of efforts to obtain funding through the Lilly Endowment Inc. GIFT VII program.

Just in time for Christmas in 2020, we received word from Lilly Endowment that it had approved a $1.8 million grant for the Foundation to help finance the Child Care Network project.

Speed on through the following two years and the bumps of a continuing COVID-19 pandemic and its resulting higher costs for construction materials, furnishings, kitchen appliances and other items associated with a construction remodel, and you arrive at January 2023.

That is when Child Care Network really did it. They opened the 100-plus seat child-care center in the former Seymour Christian Church at Fifth and Chestnut streets downtown.

Now, parents with newborns and youngsters as old as five have a new, wonderful place to receive high-quality child care. Families struggling financially can receive a stipend to help cover the fees, a stipend also funded through that Lilly grant.

Stories like this are among the many reasons why the Community Foundation of Jackson County joins more than 900 other community foundations across America to mark Community Foundation Week, set this year for Nov. 12-18.

Our goal in participating is to raise awareness about the role of philanthropy and to foster local collaborations and innovations to address persistent civic and economic challenges – including poverty and the lack of child care — in our community.

The Foundation serves all of Jackson County, from Reddington to Crothersville to Medora to Freetown to Seymour and all points in between, including Brownstown. A check of our grant and scholarship recipients easily illustrates that point.

Launched Nov. 12, 1989, through a proclamation by former President George H.W. Bush, the first Community Foundation Week included a congressional briefing about the work of community foundations throughout the nation and their collaborative approach to working with the public, private and nonprofit sectors to address community challenges. The first community foundation was established in 1914 in Cleveland, Ohio.

Community foundations in Indiana alone made more than $194 million in grants in 2020 and held more than $4.3 billion in assets. Your Community Foundation of Jackson County manages more than $16 million in assets. Last year, it awarded $899,595 in grants and scholarships.

Former Indiana Secretary of State Connie Lawson once described the role of community foundations this way: “Community foundations in Indiana play a key role in identifying and solving problems across our state. Each foundation has an in-depth knowledge of local concerns which enables them to effectively address the root of many issues. They are the drivers of community enhancements and push our state forward.”

The Community Foundation of Jackson County tries to live up to that description through our prudent stewardship of gifts, our annual grant-making cycles, our Impact Grants, our scholarship program and our involvement in the community, including our support in the creation and construction of the Jackson County Learning Center, our work with the Jackson County Education Coalition and our grant dollars to help others.

Since its founding in 1992, the Community Foundation of Jackson County has awarded more than $12 million in grants to local organizations and scholarships to hundreds of students to help them pursue their educational dreams. As of October 31, we had awarded more than $894,000 in grants and scholarships so far this year.

The Foundation is an advocate for local philanthropy, providing opportunities for donors to make a difference in their own unique ways through charitable giving. Gifts that can keep on giving, perpetually. The Foundation celebrates the rich past of Jackson County and looks to a bright future. And as our motto says: “Together, we grow tomorrows.”

Our staff and Board of Directors, made up of 20 individuals from throughout Jackson County, invite you to explore our website, www.cfjacksoncounty.org. You’ll access a wealth of information about our organization, our current funds, our grant cycles and how you, too, can become a donor and help make a difference. If you would like, please call to make an appointment to visit with us at our offices.

Our work – funded through the gifts of people like you – help make a difference in the lives of countless people across Jackson County, people like Brooke and her three children.

As we enter the giving season, millions of people from every background will be looking to give back to the communities that have supported them. They’ll also look to ensure that their heartfelt giving — however they choose to give — will have the most impact. And a lasting impact. That’s why so many of them will choose to give to a community foundation.

A gift to your local community foundation is an investment in the future of your community. We like to say that community foundations are “here for good.” At the Community Foundation of Jackson County, we don’t think about the next election or business cycle, we think about the next generation and the next after that.

——-

Dan Davis is president and CEO of the Community Foundation of Jackson County. The Foundation offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Child Care Network cuts the ribbon for its new child-care center in downtown Seymour this past January in the photo above. Below, residents tour the play area in the child-care center. The area once served as the sanctuary for Seymour Christian Church.

About us

- The Community Foundation of Jackson County was established in 1992.

- It awarded its first grants in 1994.

- Since then, the Foundation has awarded more than $12 million in grants and scholarships.

- The Foundation administers more than 250 funds.

- Online: www.cfjacksoncounty.org

- Facebook: https://www.facebook.com/CFJacksonCounty/?fref=ts

Did you know?

- The first community foundation was created in 1914 in Cleveland, Ohio, and operates now as the Cleveland Foundation.

- Community foundations play a key role in identifying and solving community problems. Currently, more than 900 community foundations operate in urban and rural areas in every state in the United States.

- Every continent but Antarctica has a community foundation. It’s estimated that there are at least 1,200 community foundations outside of the United States and Canada.

- According to the National Philanthropic Trust’s 2022 Donor-Advised Fund Report, grantmaking from DAFs to qualified charities totaled more than $45.74 billion in 2021, and the DAF grant payout rate was the highest on record (27.3%) in 2021.

How to help

To make a donation to the Brownstown Pickleball Construction Fund, checks may be written to the Community Foundation of Jackson County with Brownstown Pickleball in the memo line and mailed to the Foundation at P.O. Box 1231, Seymour, IN 47274, or dropped off at the our office, 107 Community Drive in Seymour. Online gifts may be made through our website. Click on the “Donate Now” button or hit this link: https://www.cfjacksoncounty.org/donate-now/.

For information, call Foundation President & CEO Dan Davis, 812-523-4483.

New fund targets pickelball

Raising funds for pickleball courts in Brownstown

October 25, 2023

By Dan Davis // President & CEO

The Community Foundation of Jackson County

BROWNSTOWN — The Community Foundation of Jackson County recently joined with the Town of Brownstown to establish the Brownstown Pickleball Construction Fund.

Its goal is pretty straight forward – to collect gifts toward building pickleball courts at the town park near the Brownstown Central High School campus.

On a recent Monday evening, Brownstown Town Council signed off on a fund agreement, acting as what the Foundation calls a fiscal agent or sponsor for the Brownstown Pickleball Association, a group of Brownstown residents who really seem to love the game of pickleball.

Led by Nancy and Dennis Sterling of Brownstown, no strangers to the Foundation as they have established two funds here, the Brownstown Pickleball Association is a 10-member group that plans to build four pickleball courts on a piece of land recently added to the park at 905 W. Bridge St. Mike Tormoehlen donated the ground to the town in 2022.

The association, Nancy said, has developed a five-year plan for constructing four pickleball courts, a restroom and a shelter house at the park.

For the uninitiated (like me, I must admit), pickleball is a paddleball sport that combines elements of badminton, table tennis and tennis. Two or four players use solid paddles to hit a ball, much like a Wiffle ball, over a net.

How can you help? That’s simple. And easy. Checks and cash donations can be written to the Community Foundation of Jackson County in support of the Brownstown Pickleball Construction Fund and dropped off or mailed to the Foundation. You might write “Brownstown pickleball” in the memo line of your check.

This new fund is quite similar to the fund created several years ago that helped raise money to build the new county dog shelter in Brownstown. In that case, the Jackson County Board of Commissioners signed on as the fiscal sponsor for a grassroots group of local residents and established the Jackson County Canine Shelter Fund.

Response to the shelter fund was astounding as gifts large, small and in between came into the Foundation, all adding up to a huge impact on the community. The Foundation, and the Brownstown Pickleball Association, hope to see a similar, wide, grassroots support for the construction of pickleball courts, too.

As gifts to the new fund come in once construction starts, the Foundation will pay out recommended grants following a procedure that includes both the Town Council and the Pickleball Association. The Foundation will then pay grants to the town so that construction bills can be paid.

The cost of building four pickleball courts is estimated at $120,000. That is the first step in the association’s plans. Adding a restroom facility and shelterhouse for the pickleball courts would be next.

Dennis said a pickleball court is 20-by-44-foot and four would fit inside a regular tennis court footprint.

Nancy said local pickleballers have been playing at night at the high school tennis courts and during the winter after basketball, they have been playing at the middle school.

The Brownstown Pickleball Association is asking for your help through your financial support of this project, and the group also plans to seek grants to help with the construction costs.

During and after construction, the association plans to hold tournaments twice a year and provide up to 20 hours of clinics and use the fees from those activities to do any maintenance, upkeep and repairs on the venue, Nancy said.

Interest in pickleball is growing. Seymour presently has two courts at Gaiser Park and is in the process of adding two more. Bedford has six pickleball courts, nearby Salem has two and there are eight courts in Daviess County.

“So small communities are making this happen to get people off the couch and out into the fresh air doing more,” Nancy said.

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Mike Tormoehlen and Nancy Sterling, above, were among volunteers cutting down trees this week on property where the Brownstown Pickleball Association plans to build four pickleball courts in Brownstown.

On Facebook

The Brownstown Pickleball Association has launched a Facebook page, where residents can follow its progress.

How to help

- To make a donation to the Brownstown Pickleball Construction Fund, checks may be written to the Community Foundation of Jackson County with Brownstown Pickleball in the memo line and mailed to the Foundation at P.O. Box 1231, Seymour, IN 47274, or dropped off at the our office, 107 Community Drive in Seymour. Online gifts may be made through our website. Click on the “Donate Now” button or hit this link: https://www.cfjacksoncounty.org/donate-now/.

- For information, call Foundation President & CEO Dan Davis, 812-523-4483.

Gifts to the Gift of Grain program reaps benefits for Jackson County community

Cast your vote in Green vs. Red competition

October 16, 2023

A message to our friends down on the farm: If you are looking at moving grain to make room for this year’s harvest, now might be a good time to consider making that first gift – or your next gift – to the Gift of Grain program at the Community Foundation of Jackson County.

It’s easy to do, just as many of you are already giving such gifts to your church. Gifts of Grain can be made through local grain elevators include Premier Ag in Cortland, Bundy Brothers at Medora, Rose Acre Farms and Benson Hill at Cortland and Tampico Grain near Crothersville.

Your Gift of Grain could support any of the funds at the Foundation, quite possibly one for your church (we have several funds that pay annual grants to local churches), to scholarship funds, to community funds and specific agency funds.You many even consider starting your own fund as a family legacy.

And your gifts can count as vote in our friendly Head to Head: Green vs. Red competition.

For information about the program, or its companion program, Giving a Gift of Livestock, contact the Community Foundation of Jackson County at 812-523-4483, or send an email to president@cfjacksoncounty.org. We’ll be happy to work with you as you harvest your crops and sow the seeds to help us grow better tomorrows.

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

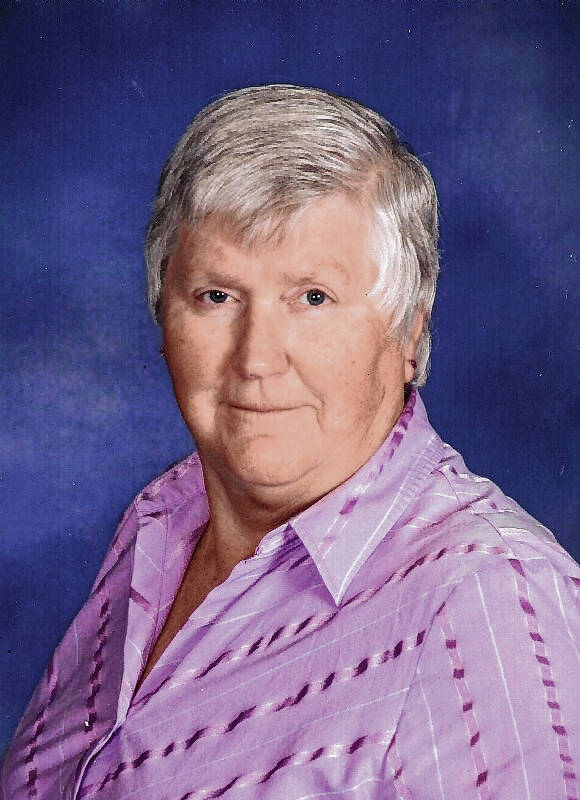

Bequest boosts classroom education grant program in Jackson County

Donald J. Klaes Classroom Education Endowment

September 11, 2023

Simple but poignant conversations among siblings led to the creation of a new fund, a larger, more impactful grant amount and a new name for the classroom education grant program at the Community Foundation of Jackson County.

Don Klaes more than once told his sister, Julie Bradley of Brownstown, that he always wanted to help, somehow, with the education of others. When Don, a Seymour resident, died in December 2020 at age 62, Bradley and her siblings established the Donald J. Klaes Classroom Education Endowment in his honor.

“My brother Don was committed to education,” Julie said. “He was a graduate of Indiana University, and throughout his life he continued his musical education well beyond his degree. During our conversations, he expressed an interest in helping today’s students with their education. By establishing this fund for classroom grants, it is our hope that each grant awarded will be used to enhance the curriculum, benefiting many students at once.

“For example,” she added, “classroom teachers could request grants to provide additional resources for books, materials, equipment, programs or activities to provide a richer student experience in the classroom.”

Effective this year, the fund, through a bequest from Don’s estate, will finance the Donald J. Klaes Classroom Education Grant Program. The program will make grants of up to $400 available to classroom teachers across Jackson County in a competitive application program, an increase from a maximum of $250 in the past.

“The fund should be able to pay out perhaps 13 or 14 grants in this first year of the newly renamed program,” Foundation President & CEO Dan Davis said. “We are excited to extend the impact of the classroom education grants and to honor Don Klaes through the generous spirit of his estate and the efforts of his siblings.”

Letters were sent this week to building principals that outline how the grant program works, and teachers may find a link to the application on the Foundation’s website, www.cfjacksoncounty.org. The deadline to submit applications is Nov. 3.

Don was also a graduate of Seymour High School. He served in the U.S. Army from 1982 to 1985, playing with the U.S. Army Band while stationed in Germany. In addition to his work with local bands and community theater, he had played in the worship band at Seymour Christian Church and The Alley Church. He was an avid chess player and a long-time employee at Mactac in Columbus.

“Don was a gifted keyboard player who was well known for his playing in several groups, churches, and with the Jackson County Community Theatre,” Dr. Chris Klaes said of his younger brother. “His talents were enjoyed by many as a member of the Ang Trio, the Elements of Jazz, and the Sound of Dreams. He also was an actor in multiple plays with JCCT.”

Prior to this year, classroom education grants were funded with earnings from the Jackson County Unrestricted Endowment, administered by the Foundation. That fund was established by the Board of Directors with gifts from Lilly Endowment Inc. to help meet community needs within Jackson County. The program was started in 2001.

“Generally, not all applicants can receive funding,” Davis said. “The Foundation takes a number of factors into consideration when awarding the classroom education grants. We have long wished that we could fund more of the requests and provide larger grants. With this generous endowment from the estate of Don Klaes, we hope to see that come to fruition this year.”

The classroom education grant program was designed to help bring to the classroom bold, creative ideas that will inspire students, Foundation Vice President Sue Smith said.

“These grants are designed to fund highly creative, but low-cost ideas,” she added. “It is our goal to encourage students and teachers to think creatively.”

The Foundation of Jackson County has established education as one of its primary areas of emphasis. The Foundation encourages teachers and their students to question, explore and find new answers to age-old questions.

“This means helping students to engage in learning in new ways and helping teachers to explore new ideas,” Davis said. “Teachers who want to explore new means, methods and bold initiatives will be in the forefront of this grant opportunity.”e all of Seymour and really all of Jackson County.

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Donald J. Klaes

How to help

You, too, can help provide grant dollars to the Donald J. Klaes Classroom Education Grant Program by making a gift to the Donald J. Klaes Classroom Education Grant Endowment.

Your gifts, large and small, can help grow the grant amount available.

For information or to make a donation, call the Foundation at 812-523-4483. Gifts may also be made online at www.cfjacksoncounty.org by clicking on DONATE NOW.

Gifts may also be mailed to the Foundation at Post Office Box 1231, Seymour, IN 47274.

About the Foundation

- The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities, and scholarship administration.

- It was created in 1992 and made its first grants in 1994.

- Since then, the Foundation has awarded more than $11 million in grants and scholarships across Jackson County.

- The charitable nonprofit administers more than 200 funds with assets of more than $17 million.

- For information about making a donation or starting a fund, call Dan Davis at 812-523-4483.

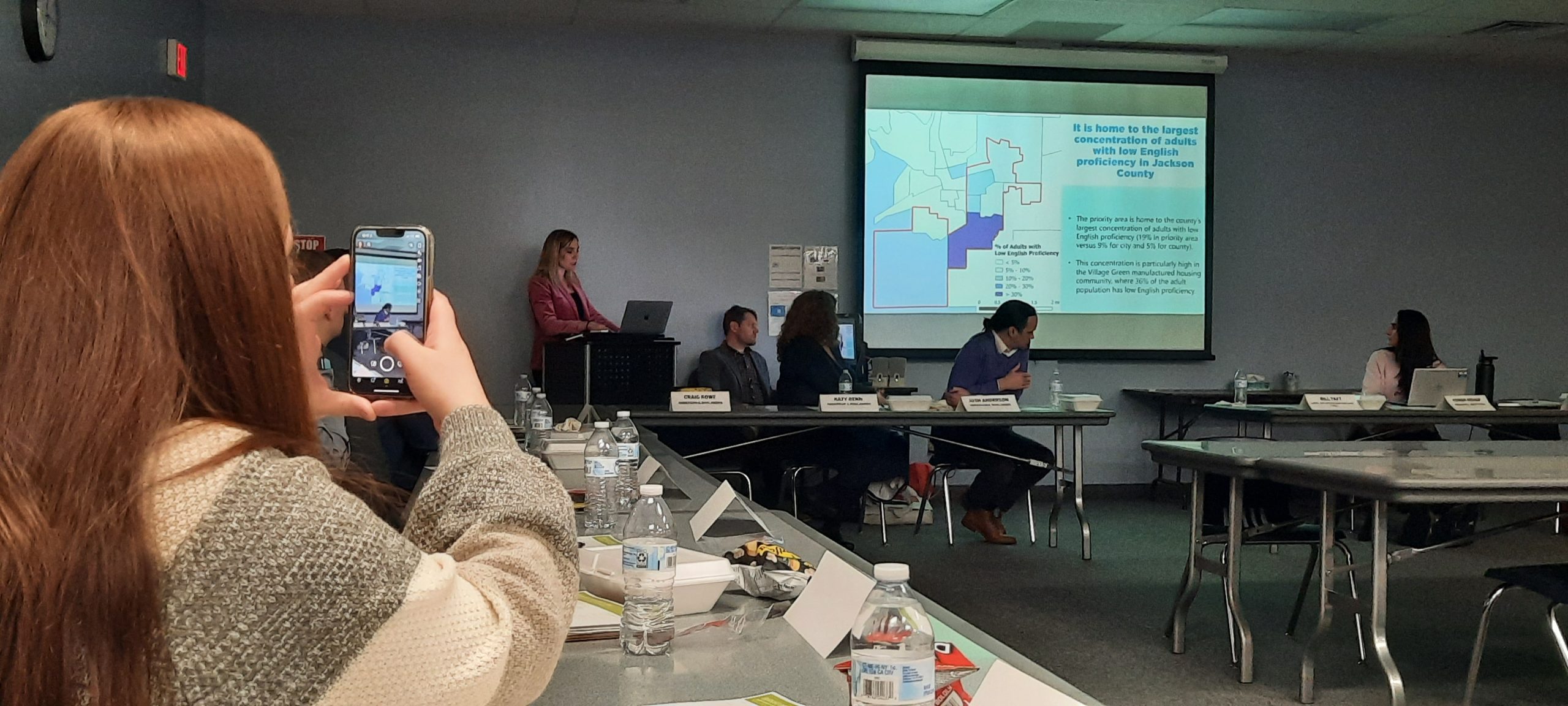

Seymour rolls out Brookings-LISC study

Report spotlights potential projects

September 11, 2023

Developing new neighborhoods. Preparing workers for new and better jobs. Creating an immigrant welcome and resource center. Building an indoor recreation center.

Those and other projects large and small make up the Burkart Opportunity Zone agenda, unveiled this week as the Seymour Brookings Institution-LISC Study team wrapped up more than 10 months of convening, planning and mapping out community needs.

The Inclusive Economic Development Agenda for Seymour offers a road map aimed at turning many of those plans into a reality over the next three years.

Seymour joined Warsaw and Michigan City at the invitation of the Indiana Economic Development Corp. in working with Brookings and the Local Initiatives Support Corp. to develop place-based strategies to span gaps in health, wealth and opportunity.

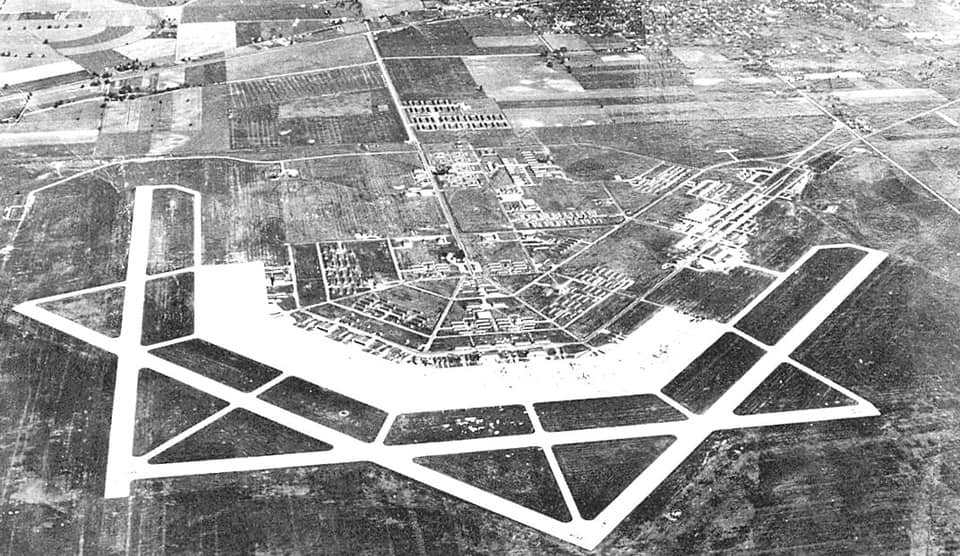

The Seymour team, comprised of a broad range of people across the community, developed a game plan for improvements in what is called the Burkart Opportunity Zone, an area running along Burkart Boulevard and encompassing the East Side Industrial Park on the northeast side to Freeman Municipal Airport to the southwest and spaces in between.

Proposals include training the local workforce and adding workforce housing; connecting people to work and play; improving affordable housing options and expanding housing options for a growing population; and creating new places and spaces for recreation and socializing.

Among those projects is a proposed welcome and resource center for new arrivals to the community and a proposal to improve multi-lingual communications. They help tackle a primary aim of the study to better connect Seymour’s growing immigrant population – from Mexico, Central America and elsewhere – to the overall community, thereby moving the entire community forward economically. The city’s population grew from 17,503 in the 2010 census to 21,569 in the 2020 census, due largely to an increase in the Latino/Hispanic population.

“We think these community-based efforts offer wonderful opportunities to bring our growing immigrant community closer to our community overall,” said Ashley Caceres, executive director of Su Casa. Caceres is teaming with Jackson County United Way Executive Maci Baurle to lead efforts on developing a resource center, reducing language barriers and creating a new community space in the Opportunity Zone.

Representatives of the City of Seymour, Jackson County Industrial Development Corp. and the Community Foundation of Jackson County served as the core team working with Brookings, LISC and its consultants, Anderson+Bohlander LLC, bringing more than 20 other community members together over five months of meeting, talking and planning.

The work also included gathering several focus groups, such as employees of Pet Supplies Plus and Aisin USA, the Mayor’s Youth Council and JAG students, a pastors’ roundtable, Seymour Young Professionals, 4-H Juntos members and their families and Margaret R. Brown School Elementary School leaders.

“Bringing in those community members, especially through those focus groups, was important to ensuring that we heard from a broad range of people,” said Jackie Hill, director of the Jackson County Industrial Development Corp. Workforce Partnership program. “We wanted to make sure that their voices were heard and reflected.”

Mayor Matt Nicholson is excited for the city to have been included in the process and looks forward to the work that lies ahead.

“Being selected by the State of Indiana for this project has presented us a tremendous opportunity to not only bring many residents to the table to discuss the future of Seymour but also to put plans together to work toward making these changes a reality,” he said.

Forward momentum

Moving from planning to starting and completing projects is important, JCIDC Executive Director Jim Plump added.

“No one wants to be handed another report to toss onto the shelf behind them,” Plump said. “This agenda will be put into play over the next several years, and we hope this will be a springboard for projects when we work on the state’s READI 2.0 project next year.”

Helping ensure that work happens, individuals and entities are stepping up to serve as cheerleaders and project pushers, heading up efforts to keep the momentum moving toward completing the proposed projects, finding funding and checking off the projects as completed.

The core team will continue to meet quarterly and receive updates from project leaders, helping monitor progress and keeping the momentum moving forward.

“Now is a great time for those already involved – and those who have yet to be involved but want to be – to step up, engage in the work and help improve our overall community,” Foundation President & CEO Dan Davis said, adding that while the Brookings-LISC Study narrowed the focus to one primary area of Seymour, the core leadership team and others involved in the process are confident the work so far and the project work to come will help improve all of Seymour and really all of Jackson County.

The overall plans for Seymour, Warsaw and Michigan City are based on the principles of what Brookings and LISC call Community-Centered Economic Inclusion, which builds community wealth within underinvested places by directly engaging with residents; breaking down barriers related to race, income and geography; and connecting to broader economic growth in the region.

The inclusion work has been successfully piloted and expanded in 12 large cities over the past few years — showing progress where some other community investment programs have fallen short. It is now being adapted to small cities, offering a model for data-informed local planning and mobilization that connects places like Michigan City, Seymour and Warsaw and promotes growth within their own counties and neighboring counties.

“It is clear from both data and experience that equity-focused community investment plans can produce sustainable gains that have a positive ripple effect beyond any one project or neighborhood,” said William Taft, Senior Vice President of Economic Development with LISC and an Indiana native. “For these three cities, these goals are achievable. They have committed local champions behind them, and they offer great opportunities for investors to empower real community-driven transformation.”

About the study

The project involving Seymour, Warsaw and Michigan City was aimed at exploring how the state can better help smaller communities grow and be more inclusive in economic development.

“Oftentimes, small cities don’t have access to the kind of community development

infrastructure that large municipalities do when working to build economic opportunity and align with regional economies,” according to the Indiana Economic Development Corporation, which is supporting the three-city effort. “It makes it more difficult to attract the capital and expertise needed to fuel revitalization and growth, and it impacts the well-being of tens of thousands of Indiana families. These three plans directly address those challenges in ways that will have a lasting impact.”

Each community tailored its strategy to its local assets, needs and opportunities.

Together their plans shared many common goals — such as expanding career pathways to high-quality jobs, building and preserving affordable housing and transforming distressed or underutilized land into vibrant commercial facilities and public space for arts and recreation.

“The well-being of our cities and our nation depends on creating equitable landscapes of opportunity where more people, small businesses, and places can thrive,” said Hanna Love, a senior research associate at Brookings. “CCEI provides local leaders with the tools to lay the groundwork for a strong and healthy future, and to do so in a way that is accountable to communities that have for too long been denied the chance to thrive.”

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Agenda action tasks

- Enhance career pathways and build small businesses: Train existing workers for advancement and encourage small business growth through entrepreneur support.

- Welcome new immigrants: Develop an immigrant welcome or resource center, strengthen multi-lingual communications and create a community space on the south side.

- Connect people to work and play: Fill in the gaps and expand the city’s trail system and create a new master plan for parks.

- Improve affordable living options: Improve residential and apartment conditions and develop new, affordable train-side communities.

- Expand housing options for a growing population: Create what is tentatively called Freeman Village, a new neighborhood, and support first-time home buyers.

- Create new places for recreation and socializing: Build a new indoor recreation facility and cultivate third-places through creative place making.

Overheard

“Now is a great time for those already involved – and those who have yet to be involved but want to be – to step up, engage in the work and help improve our overall community,” Foundation President & CEO Dan Davis said. Although the Brookings Institution-LISC Study narrowed the focus to one primary area of Seymour, the core leadership team and others involved in the process are confident the work so far and the project work to come will help improve all of Seymour and really all of Jackson County, Davis added.

“This agenda will be put into play over the next several years, and we hope this will be a springboard for projects when we work on the state’s READI 2.0 project next year,” said Jim Plump, Executive Director of the Jackson County Industrial Development Corp.

Watch Video

To watch a video at the Seymour Brookings Institution-LISC Study, please click below

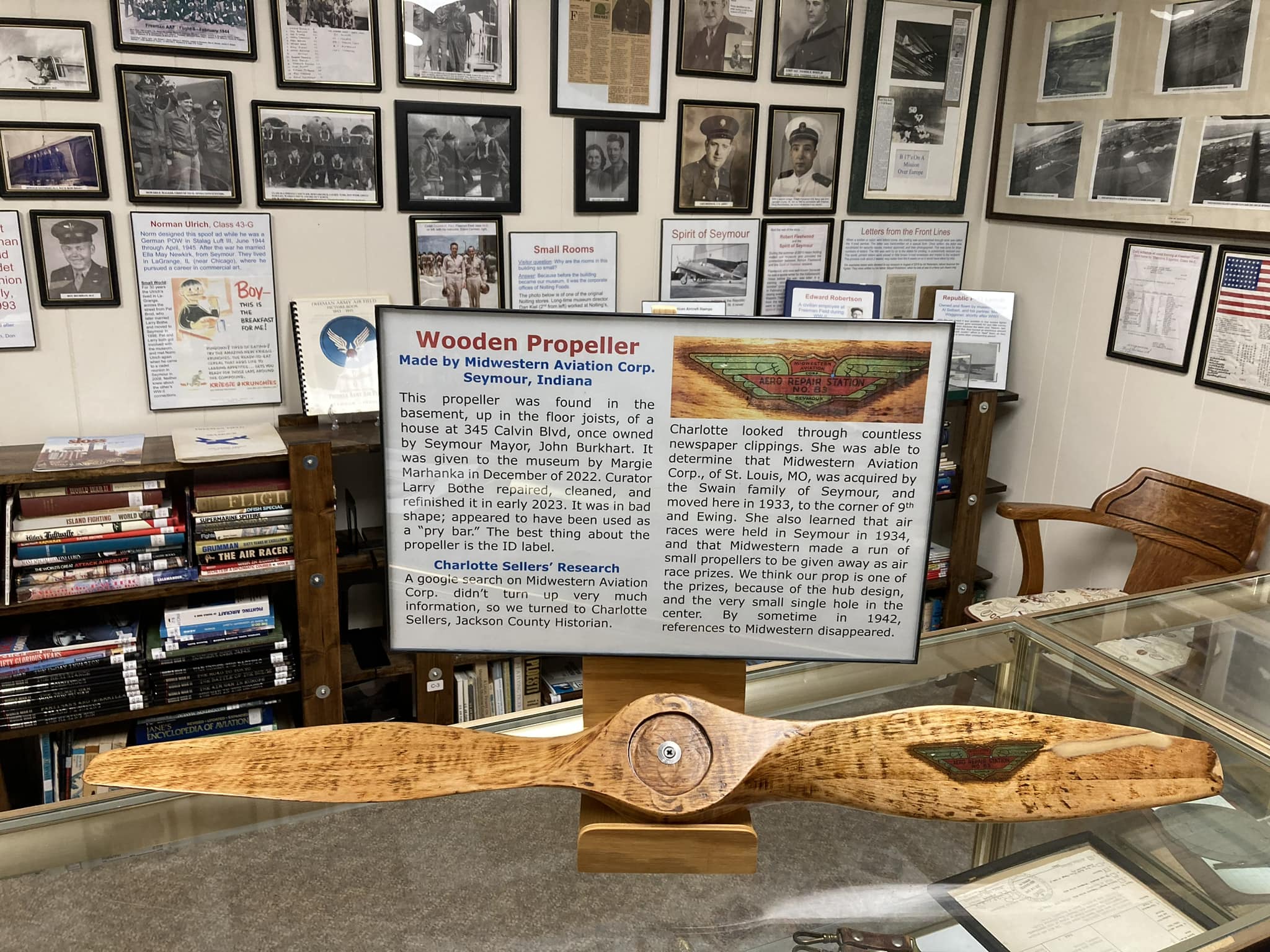

Teachers give back to community

Stuckwisch Educational Scholarship Fund

September 4, 2023

By Dan Davis // President & CEO

The Community Foundation of Jackson County

Giving back and helping ensure young people interested in being teachers have an opportunity to attend college explain why Joyce and John Stuckwisch created the Stuckwisch Educational Scholarship Fund in April 2006.

The fund, one of 67 scholarship funds administered by the Community Foundation of Jackson County, has a primary goal of providing scholarships to graduating seniors of Brownstown Central High School who are interested in pursuing a career in education. Both Joyce and John retired from Brownstown Central.

Since the fund’s inception, the couple has made a gift to the fund that matches what is paid out in scholarships each year, ensuring that the fund has grown over the years. Since John’s death in January 2022, Joyce has continued that practice. They incorporated the use of their IRA distributions to power the fund’s growth and impact.

The Stuckwisches illustrate great dedication to the community work they started and follow some best practices such as annual giving and giving to match the annual payout. Directing qualified charitable deductions from retirement funds is a great means of helping donors make a difference in our community. It is becoming a more common gift to the Foundation.

Both John and Joyce taught at Brownstown Central High School. He taught math for 36 years, and she taught Spanish there for 28 years after first teaching for six years in Decatur County. Joyce is a graduate of Greensburg High School, and John graduated from what was then known as Brownstown High School.

“With the two of us, we saved our money wisely and we both grew up in families that struggled financially at times,” Joyce said. “We felt we could help some people get out of life what they wanted by helping them go to college and also help out our schools.”

The love of their careers also helped lead them to create the scholarship fund.

“We both enjoyed teaching so much, we wanted to see that the students in Brownstown who were interested in teaching had the opportunity to go to college if they wanted to,” Joyce added about their decision.

Her advice for others considering how to help make a difference through their giving?

“Consider what you have and how you can help others,” Joyce said. “Grow it little by little.”

She’s right. That steady growth, collectively, adds up and makes a huge impact.

Whether you are interested in starting a scholarship fund, like John and Joyce, or perhaps a designated fund that might help a nonprofit organization that you support, or maybe a community fund where the grant options are wide open, give us a call at the Foundation.

We would be happy to arrange a time to talk, to learn more about how you want to help and the options available to help you do that wisely. Giving through your retirement distributions can be part of that conversation.

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

About the Foundation

- The Community Foundation of Jackson County administers 67 scholarship funds and more than 250 funds overall.

- The Foundation was established in 1992.

- It paid its first grants in 1994.

- Grants and scholarships paid since then total more than $11 million.

- Current assets total more than $17 million.

- The Foundation’s staff includes three full-time and one part-time.

- Our Board of Directors consists of 20 individuals from all across Jackson County.

Local giving bucks national trend

Overall: American giving down in 2022

August 4, 2023

By Dan Davis

President & CEO

The Community Foundation of Jackson County

Jackson County residents and institutions rose above a national trend in giving during 2022, or at least in their giving to the Community Foundation of Jackson County.

Nationally, Americans continued to give generously during this past year, although overall giving declined after two years of record generosity.

That news comes from the recently published Giving USA 2023: The Annual Report on Philanthropy for the Year 2022 as it shows that individuals, bequests, foundations and corporations awarded an estimated $499.33 billion to U.S. charities.

Stock market losses and economic uncertainty, including high inflation, emerged as chief suspects in the dampening of giving, the report concludes. Total giving declined 3.4 percent in current dollars – down 10.5 percent after adjusting for inflation – from a revised total of $516.65 billion in 2021, the report states.

Here at home, the Community Foundation of Jackson County received $932,676.71 in new gifts during 2022, up from $845,134.34 in 2021 — much appreciated giving to help fund important work and scholarships. During the same time, the Foundation awarded $899,595.32 in overall grants and scholarships during 2022.

Those grants funded good work throughout the community, including:

- Support for opening the new Child Care Network child-care center.

- Creative Classroom Education Grants.

- A record $103,000 in Fall Grant awards to help feed the hungry, house the homeless, fight fires, educate children, support our immigrant population, preserve history and support the Community Agency Building.

Overall, giving to foundations is estimated to have increased by 10.1 percent in 2022, to $56.84 billion, according to the report. As noted earlier, giving to the Community Foundation of Jackson County totaled $932,676.71 or 10.2 percent. Adjusted for inflation, overall giving to foundations grew by 1.9 percent, about the same here to the Community Foundation.

The Giving USA report, the longest-running report on the sources and uses of charitable giving in America, is published by the Giving USA Foundation, a public service initiative of The Giving Institute. It is researched and written by the Indiana University Lilly Family School of Philanthropy at IUPUI. It reports giving had been strong in 2020 and 2021 – which held true here at the Foundation as well – with donors responding to growing need in the wake of the COVID-19 pandemic. The Foundation saw record giving of $1.17 million in 2020.

Total charitable giving has fallen only three other times in the last 40 years in current dollars: in 1987, 2008 and 2009, the report states.

The bottom line here is that decreases in giving can negatively affect the ability of local nonprofits to meet the real-life needs of the people they serve, reducing their impact and reach on helping those among us who most need a hand up.

“Drops in the stock market and high inflation caused many households to make tough decisions about their charitable giving for the year,” said Josh Birkholz, chair of the Giving USA Foundation. “But despite uncertain economic times, Americans demonstrated how essential they view the nonprofit sector and its ability to solve big problems — by still giving nearly half a trillion dollars in 2022.”

Amir Pasic, the dean of the Lilly Family School of Philanthropy, agreed.

“Declines in giving like those we saw in 2022 have a tangible impact on nonprofit organizations, especially those that rely on charitable dollars to support their daily work,” Pasic said. “… However, Giving USA’s historical data also provide a case for hope: we have seen charitable giving rebound from each decline.”

The Community Foundation of Jackson County’s Board of Directors and staff hope that proves true again. Though sometimes on a rollercoaster ride, our investment returns are up so far this year and new giving to the Foundation totaled $438,940.45 through July 31. That’s a good pace should the trend continue through the end of the year.

The report showed growth in three of the four sources of giving in 2022 in current dollars, but all four sources declined when adjusted for inflation. Giving by foundations and corporations posted positive two-year growth, even when adjusting for inflation.

Measured in current dollars, giving grew in five of the nine categories of nonprofits that receive charitable contributions, although this growth largely did not keep pace with the 8% inflation rate. In inflation-adjusted terms, seven of these nine subsectors experienced a decline. Giving to foundations and giving to international affairs both grew in inflation-adjusted terms, at 1.9% and 2.7% respectively.

As noted earlier, giving to the Community Foundation of Jackson County was strong again in 2022 with gifts totaling more than $930,000.

Local giving, we believe, is a result of our community stepping up in a time of need and a recognition of the work that the Foundation and our many community partners do, playing a vital role in collaborating with other nonprofits performing important work across our community. We value, understand and appreciate the giving of our donors.

Without the generosity of those individuals, organizations and businesses, our work could not take place.

Thank you for giving. Thank you for supporting our community. Thank you for supporting the Community Foundation of Jackson County.

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

Charitable giving by source

- Giving by individuals totaled an estimated $319.04 billion, declining 6.4 percent in 2022 (a decline of 13.4 percent, adjusted for inflation).

- Giving by foundations grew 2.5 percent, to an estimated $105.21 billion in 2022 (a decline of 5.0 percent).

- Giving by bequest totaled an estimated $45.60 billion in 2022, growing by 2.3 percent over 2021 (a decline of 5.3 percent).

- Giving by corporations is estimated to have increased by 3.4 percent in 2022, totaling $29.48 billion (a decline of 4.2 percent).

— SOURCE: Giving USA 2023

Charitable giving to recipients

- Giving to religion grew by 5.2 percent between 2021 and 2022, with an estimated $143.57 billion in contributions. Inflation-adjusted giving to the religion subsector declined by 2.6 percent.

- Giving to human services reached $71.98 billion, and declined by 0.6% in current dollars, staying relatively flat with 2021. Adjusted for inflation, giving to human services organizations declined by -8.0 percent.

- Giving to education is estimated to have declined 3.6 percent between 2021 and 2022, to $70.07 billion. Adjusted for inflation, giving to education organizations declined 10.7 percent.

- Giving to foundations is estimated to have increased by 10.1 percent in 2022, to $56.84 billion. As noted earlier, giving to the Community Foundation of Jackson County totaled $932,676.71 or 10.2 percent. Adjusted for inflation, overall giving to foundations grew by 1.9 percent.

- Giving to health is estimated to have grown by 5.1 percent between 2021 and 2022 (a decline of 2.6 percent), to $51.08 billion.

- Giving to public-society benefit organizations decreased an estimated 8.4 percent between 2021 and 2022, to $46.86 billion. Adjusted for inflation, giving to public-society benefit organizations declined by 15.2 percent.

- Giving to arts, culture, and humanities is estimated to have increased 2.9 percent between 2021 and 2022, to $24.67 billion. Adjusted for inflation, giving to the arts, culture, and humanities subsector declined by 8.9 percent.

- Giving to environmental and animal organizations is estimated to have decreased 1.6 percent between 2021 and 2022, to $16.10 billion. Adjusted for inflation, donations to the environment/animals subsector declined by 8.9 percent.

— SOURCE: Giving USA 2023.

Fall Grants power community work

Deadline to apply is July 31

June 19, 2023

By Dan Davis

President & CEO

The Community Foundation of Jackson County

The Community Foundation of Jackson County encourages giving and provides grants to help programs and the people they serve throughout our community.

The Foundation staff and our 20-member Board of Directors, with help from other community volunteers, do our best to wisely administer more than $16 million in assets to generate earnings that fund scholarships, classroom education grants, community impact grants and our Fall Grant cycle.

Those grants make an impact across Jackson County. Last year, for instance, we awarded 16 Fall Grants and helped people and programs in Brownstown, Crothersville, Medora, Seymour and places in between.

They totaled $103,677, the most ever funded through the Fall Grant cycle, and included two grants that will help fight food insecurity across Jackson County, two others that will help local fire departments, and five others that will help address educational and public safety issues.

Work on this year’s Fall Grant Cycle is under way with a July 31 application deadline. Over the next several weeks, Foundation Vice President Sue Smith and I will answer questions, review drafts and accept applications. Forms are available now online. Click on GRANTS on the toolbar at the top of this page.

Once the deadline passes and Sue reviews them for compliance (all applications must involve 501(c)3 organizations or qualifying governmental units), our grant committee will conduct site visits to investigate the requests and their needs.

Two factors can play a great role in determining grants: whether a nonprofit’s board is engaged financially and whether other funding sources are being pursued for the project. We like to see board members with skin in the game (our board members certainly are), and we support the practice of bringing funding partners together to deal with community issues and needs. Examples include how the Foundation worked with Jackson County United Way to meet the needs of nonprofits during the COVID-19 pandemic and is working with Child Care Network and other community partners to leverage support and assets for the opening of a community child-care center.

Once the site visits are completed, the Foundation staff and grant committee convene to determine which applications will be recommended for grants. This will take place in October, and our Board will consider the recommendations later that month. While we’d like to say every organization that applies receives funding, we can’t. Applications often total more than is available for granting. Tough decisions are made.

In 2014, the Foundation approved $32,536 in Fall Grants. That number was $38,195 just five years ago, and this past year we hit $103,000 – the first time to surpass $100,000. That growth has come through conversations with potential donors and long-time donors, explaining the importance, value and versatility of community funds, enabling the Foundation to respond to emerging needs.

The number of endowed community funds has increased, a result of the Foundation deciding in 2015 to focus on such funds. Then, we had 13 community funds. At the end of 2022, the number had grown to 29. Those 16 newest community funds alone had a total balance of $1,094,289 on Dec. 31, 2022. Community funds now make up 12 percent of our funds and account for 20 percent of our fund assets.

Your new gifts, of course, can help make those grant dollars grow in the future as well. If you would like to donate to any of the Foundation’s endowed funds or to create your own endowed fund, call me at 812-523-4483 to set up an appointment. We can discuss your interest in helping others in the community and how to make your assistance a reality.

Your endowed gifts can, through prudent investment, generate earnings for scholarships, classroom education grants, fall grants, agency grants and community impact grants to help people across Jackson County. Over and over, year after year. Forever.

——-

The Community Foundation of Jackson County offers endowment services, gift planning, charitable gift annuities and scholarship administration. Our office is at 107 Community Drive, Seymour, IN 47274. For information or to make a gift, call 812-523-4483, or click the DONATE NOW button here on our website.

How to help

You can make gifts to the community funds and field of interest funds administered by the Community Foundation of Jackson County. For information about how you can make a donation to any of the funds administered by the Foundation or how you might start a new fund, call 812-523-4483 or send an email to Dan Davis at president@cfjacksoncounty.org.

How to apply

The deadline to apply for a Fall Grant at the Community Foundation of Jackson County is July 31. Applications are online at www.cfjacksoncounty.org.

Members of Seymour Fire Department demonstrate communication gear that a 2022 Fall Grant funded. The equipment provides for better communication en route to and on the scene of emergency situations faced by firefighters. The deadline to apply for the 2023 Fall Grant cycle is approaching. The deadline is July 31.

Scholarship honors Coach Sullivan

Trinity, Seymour students eligible for scholarship

June 14, 2023

By Dan Davis

President & CEO

The Community Foundation of Jackson County